block input tax malaysia list

ITC is used for payment of output tax. Input Tax Credit ITC of the tax paid on almost all taxable supply of goods or services or both used in the course or furtherance of business is allowed under GST except.

Peru Indirect Tax Guide Kpmg Global

A company will be a malaysian tax resident if at any time during the basis.

. Gst Input Tax Credit Accounting Tally. We will get it fixed as soon as possible. 36 period to claim input tax.

2 The supply of. Block input tax malaysia list. This company is not yet authorized.

ITC being the backbone of GST and there are many condition to claim ITC on any items. 55 block input vat 60 other taxes 61. Block input tax malaysia list.

Block Input Tax Malaysia List - Income Tax Fundamentals 2017 with HR Block Premium. Block input tax malaysia list Sunday February 20 2022 Edit. The GST rate previously proposed in the GST bill in 2009 by the Malaysian Government was 6.

However you may be required to account for output tax on the Open Market Value OMV of the goods if its cost. The input tax credit mechanism ensures that GST is chargeable only on the value added by a business. Hr block is one of the biggest names in tax.

1 Where the goods or services or both are used by the registered perso n partly for the purpose of any business and. 1 The supply to or importation by him of a passenger motor car. It is further guided based on Regulation to prescribe on the items that are excluded.

As the old adage goes taxes are a fact of life. Those gst you cant claim is called blocked input tax credit. Sorry for the inconvenience.

But there are some cases where ITC is blocked. A the supply to or importation by him of a passenger motor car. When purchasing from GST-registered suppliers or importing goods into Singapore you may have incurred GST input tax.

Input tax claims are allowed subject to the conditions for input tax claim. Without ITC GST would be charged on gross sales by every business throughout. Block input tax malaysia list.

Conditions for Claiming Input Tax. Corporate tax rate in malaysia averaged 2612. Contrary to popular belief not all GST input tax incurred can be claim.

Input tax incurred can be claimed in respect of the supplies made outside malaysia which would be taxable supplies if made in malaysia. Stamp atx 65 specific tax on certain merchandise and services 66 public lighting tax 67. Which would be taxable supplies if made in Malaysia.

In the meantime you can go to our home page or use our help centre. Offsetting input tax against output tax. For GST Malaysia there are 3 types of.

ITEMS ON WHICH CREDIT NOT ALLOWED IN GST. You dont need to finish creating your app in Xcode before entering its information in App Store Connect. MYOB Price List Malaysia MYOB Payroll Free.

You can claim the input tax. Input tax incurred can be claimed in respect of the supplies made outside Malaysia which would be taxable supplies if made in. Overseas transaction has always been a.

At this point in time the rate may be slightly higher. Blocked GST input tax claims. The goods or services are used or will be used for the purpose.

The following are the expenses that are.

What Is Blocked Input Tax Credit In Gst Goods Services Tax Gst Malaysia Nbc Group

Are Irs Security Tools Blocking Millions Of People From Filing Electronically

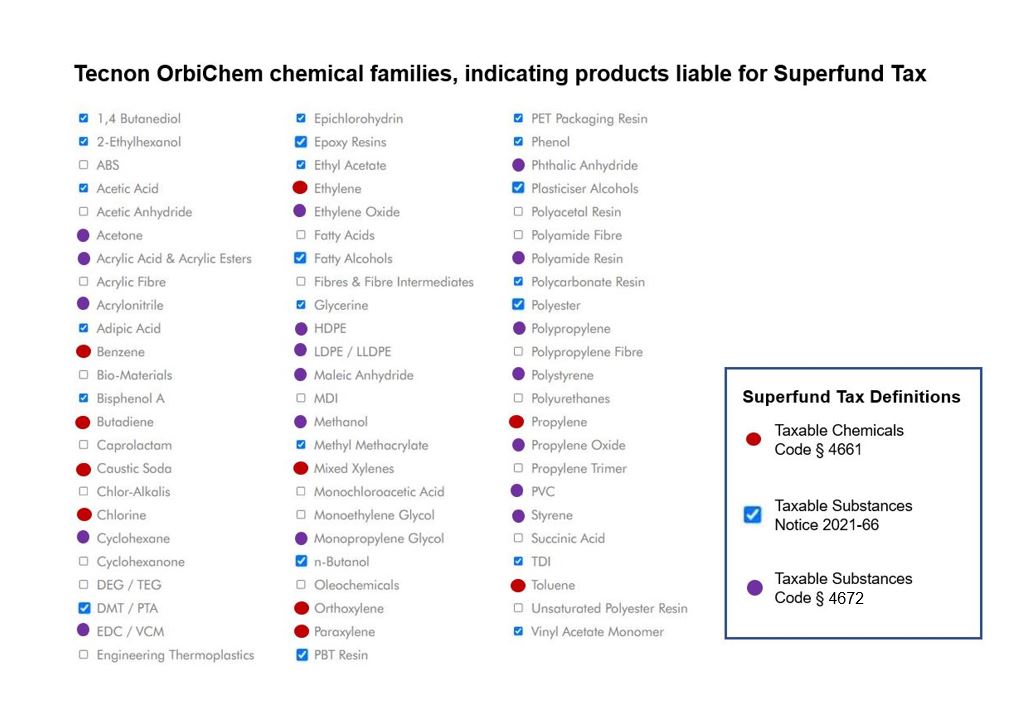

Superfund Tax Revival Of An Old Tax In The Us

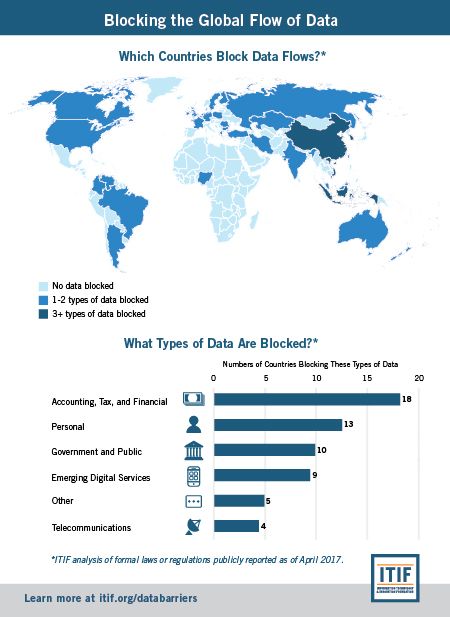

Cross Border Data Flows Where Are The Barriers And What Do They Cost Itif

Amazon Com Nc Dc 12v Zoter Electric Drop Bolt Door Lock Deadbolt Strike Fail Safe Mode Tools Home Improvement

What Is Blocked Input Tax Credit In Gst Goods Services Tax Gst Malaysia Nbc Group

Fiori App Library List Tutorial S 4hana Sap Blogs

Secure File Transfer In Sitefinity You Can Moveit

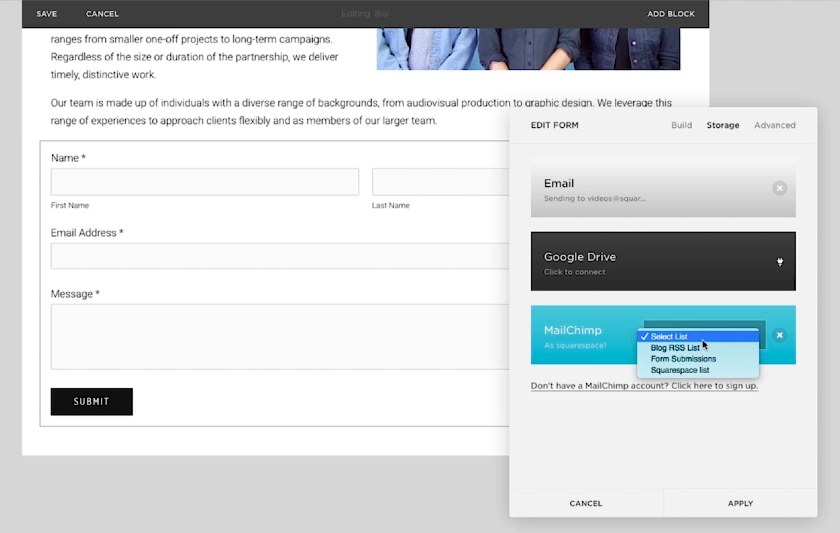

16 Best Squarespace Plugins Extensions For Small Businesses

Exploring The Building Blocks Book 4 Set Real Science 4 Kids

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

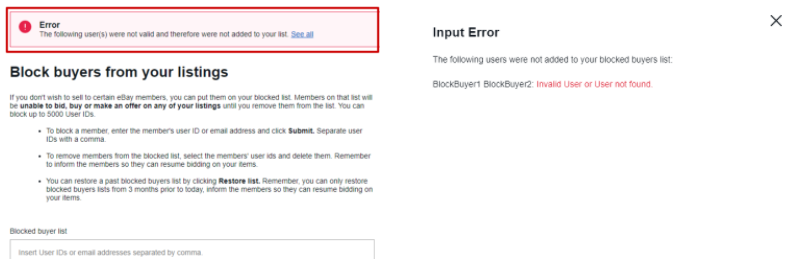

A Guide To Blocking An Ebay Buyer Business 2 Community

Gst Guide For Input Tax Credit

How To Avoid Costly Gst Errors Estream Software

Ofac Screening Requirements Best Practices For Compliance Alessa

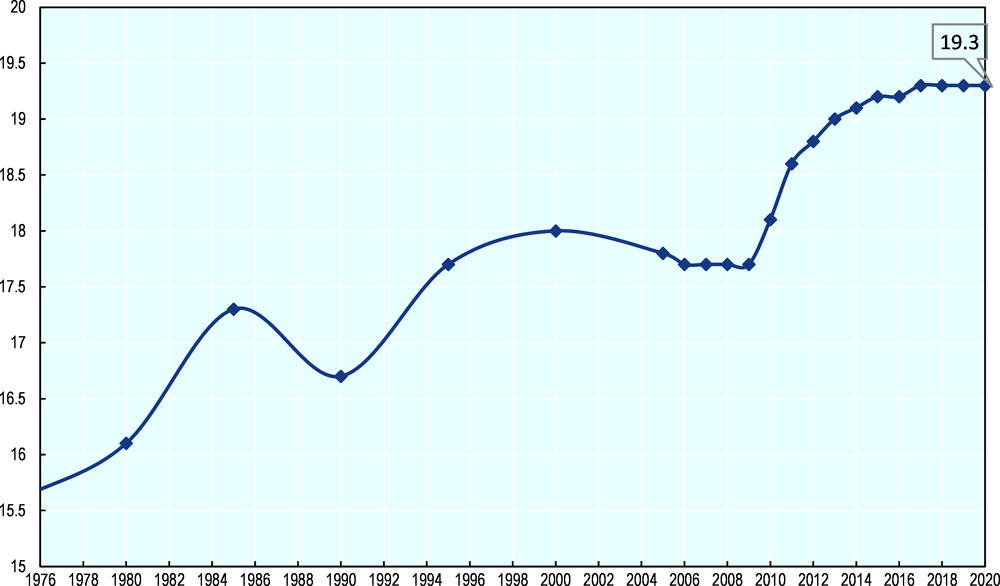

2 Value Added Taxes Main Features And Implementation Issues Consumption Tax Trends 2020 Vat Gst And Excise Rates Trends And Policy Issues Oecd Ilibrary